is interest an expense account

Capital leases are the exception because youre leasing an asset rather than borrowing money. Any time you borrow money, whether from an individual, another business, or a bank, youll have to repay it with interest. The amount of interest expense for companies that have debt depends on the broad level of interest rates in the economy. Lets say a company borrows $5,000 from the American National Bank, with an annual interest rate of 5%. Decide which period youll be calculating your interest expense for. Cost of debt is the effective rate that a company pays on its current debt as part of its capital structure. Interest expenses are debits because in double-entry bookkeeping debits increase expenses.

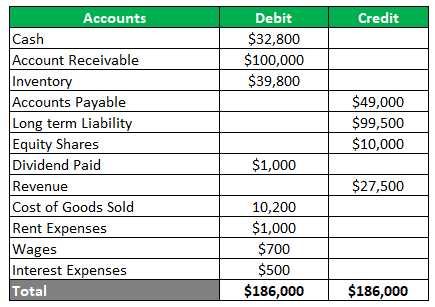

Liquidity Ratios: What's the Difference? She most recently worked at Duke University and is the owner of Peggy James, CPA, PLLC, serving small businesses, nonprofits, solopreneurs, freelancers, and individuals. Coverage ratios can be used to dig deeper. Attracting high net worth clients involves understanding their needs. Just fill in the recurring date and interval, and youre good to go! While interest expense is an expense account in the income statement, that represents the total amount of the interest from borrowing cash. This compensation may impact how and where listings appear. After all, unless the owner is managing the business just for fun, they want to expand operations in the hopes of earning more money. Short-term debts are paid within 6 months to a year and include lines of credit, installment loans, or invoice financing. The accounting equation is the foundation of double-entry bookkeeping[/blog/double-entry-bookkeeping/] which is the bookkeeping method , Invoice Management Guide for Small Business - Complete Guide, As a small business owner, youll have to regularly deal with issuing invoicesand paying back vendor bills in a timely manner. Heres a chart of accounts with their corresponding debits and credits to understand the concept better: Now that we covered all of the basics, lets check out some examples. Before diving into some business examples on how to make journal entries for interest expenses, lets first go over some accounting basics youll need to know. It represents interest payable on any borrowingsbonds, loans, convertible debt or lines of credit. These include white papers, government data, original reporting, and interviews with industry experts. Until they are due, you cannot recognize them as expenses according to the loan agreement. Now, since the business works under the accrual basis of accounting, the interest expense will be recorded at the end of the month, for the next 3 months. Effective Rate of Interest Calculation At the end of the day, your business is only asrelia, The biggest and the smallest of businesses have one sure thing in common: they all have vendors. Next, complete checkout for full access to Deskera Blog, Welcome back! Even the most qualified accountants do. Julia Kagan has written about personal finance for more than 25 years and for Investopedia since 2014. The loan's purpose is also critical in determining tax-deductibility of interest expense. click here to download the Know Your Economics Worksheet, The Struggles of Private Company Accounting, The Art Of The CFO: Financial Leadership Workshop. A term you might confuse with interest expense is interest payable. To measure the ability to pay back interest, businesses can use the interest coverage ratio. Recurring payments built for subscriptions, Training resources, documentation, and more. .css-1fbt1mu{-webkit-align-items:baseline;-webkit-box-align:baseline;-ms-flex-align:baseline;align-items:baseline;margin:0;padding:0;-webkit-appearance:none;-moz-appearance:none;-ms-appearance:none;appearance:none;-webkit-user-select:none;-moz-user-select:none;-ms-user-select:none;user-select:none;border:none;border-radius:0;background:none;font-family:inherit;font-weight:inherit;font-size:inherit;line-height:inherit;color:inherit;width:auto;cursor:pointer;-webkit-text-decoration:none;text-decoration:none;-webkit-box-flex-wrap:nowrap;-webkit-flex-wrap:nowrap;-ms-flex-wrap:nowrap;flex-wrap:nowrap;display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;-webkit-box-pack:center;-ms-flex-pack:center;-webkit-justify-content:center;justify-content:center;font-weight:600;text-align:center;border-radius:calc(12px + 24px);color:#f3f4f5;background-color:#5f24d2;-webkit-transition:border 150ms,background 150ms,-webkit-transform 100ms ease-in-out;transition:border 150ms,background 150ms,transform 100ms ease-in-out;border:1px solid #5f24d2;padding:8px 32px;font-size:16px;line-height:24px;width:auto;display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;}a.css-1fbt1mu,button.css-1fbt1mu{-webkit-user-select:none;-moz-user-select:none;-ms-user-select:none;user-select:none;}.css-1fbt1mu:hover,.css-1fbt1mu:focus,.css-1fbt1mu[data-hover],.css-1fbt1mu[data-focus]{color:#f3f4f5;background-color:#875add;border-color:#875add;}.css-1fbt1mu:focus,.css-1fbt1mu[data-focus]{outline:none;box-shadow:0 0 0 2px #c7b2ef;}.css-1fbt1mu:focus:not(:focus-visible){box-shadow:none;}.css-1fbt1mu:active,.css-1fbt1mu[data-active]{color:#f3f4f5;background-color:#4c1ca8;border-color:#4c1ca8;-webkit-transform:scale(.985, .985);-moz-transform:scale(.985, .985);-ms-transform:scale(.985, .985);transform:scale(.985, .985);}.css-1fbt1mu.css-1fbt1mu:disabled,.css-1fbt1mu.css-1fbt1mu[disabled]{background-color:#e4e5e7;border-color:#e4e5e7;color:#8f9197;}.css-1fbt1mu:disabled,.css-1fbt1mu[disabled]{cursor:not-allowed;-webkit-text-decoration:none;text-decoration:none;}Get Started.css-zypsol{-webkit-align-items:baseline;-webkit-box-align:baseline;-ms-flex-align:baseline;align-items:baseline;margin:0;padding:0;-webkit-appearance:none;-moz-appearance:none;-ms-appearance:none;appearance:none;-webkit-user-select:none;-moz-user-select:none;-ms-user-select:none;user-select:none;border:none;border-radius:0;background:none;font-family:inherit;font-weight:inherit;font-size:inherit;line-height:inherit;color:inherit;width:auto;cursor:pointer;-webkit-text-decoration:none;text-decoration:none;-webkit-box-flex-wrap:nowrap;-webkit-flex-wrap:nowrap;-ms-flex-wrap:nowrap;flex-wrap:nowrap;display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;-webkit-box-pack:center;-ms-flex-pack:center;-webkit-justify-content:center;justify-content:center;font-weight:600;text-align:center;border-radius:calc(12px + 24px);color:#f3f4f5;background-color:#5f24d2;-webkit-transition:border 150ms,background 150ms,-webkit-transform 100ms ease-in-out;transition:border 150ms,background 150ms,transform 100ms ease-in-out;border:1px solid #5f24d2;padding:8px 32px;font-size:16px;line-height:24px;color:#5f24d2;background-color:transparent;border-color:#5f24d2;width:auto;display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;}a.css-zypsol,button.css-zypsol{-webkit-user-select:none;-moz-user-select:none;-ms-user-select:none;user-select:none;}.css-zypsol:hover,.css-zypsol:focus,.css-zypsol[data-hover],.css-zypsol[data-focus]{color:#f3f4f5;background-color:#875add;border-color:#875add;}.css-zypsol:focus,.css-zypsol[data-focus]{outline:none;box-shadow:0 0 0 2px #c7b2ef;}.css-zypsol:focus:not(:focus-visible){box-shadow:none;}.css-zypsol:active,.css-zypsol[data-active]{color:#f3f4f5;background-color:#4c1ca8;border-color:#4c1ca8;-webkit-transform:scale(.985, .985);-moz-transform:scale(.985, .985);-ms-transform:scale(.985, .985);transform:scale(.985, .985);}.css-zypsol.css-zypsol:disabled,.css-zypsol.css-zypsol[disabled]{background-color:#e4e5e7;border-color:#e4e5e7;color:#8f9197;}.css-zypsol:hover,.css-zypsol:focus,.css-zypsol[data-hover],.css-zypsol[data-focus]{color:#875add;background-color:transparent;border-color:#875add;}.css-zypsol:active,.css-zypsol[data-active]{color:#4c1ca8;background-color:transparent;border-color:#4c1ca8;}.css-zypsol.css-zypsol:disabled,.css-zypsol.css-zypsol[disabled]{background-color:transparent;}.css-zypsol:disabled,.css-zypsol[disabled]{cursor:not-allowed;-webkit-text-decoration:none;text-decoration:none;}Learn More, 2 min read .css-rqgsqp{position:relative;z-index:1;}.css-fp7fcu{-webkit-align-items:baseline;-webkit-box-align:baseline;-ms-flex-align:baseline;align-items:baseline;margin:0;padding:0;-webkit-appearance:none;-moz-appearance:none;-ms-appearance:none;appearance:none;-webkit-user-select:none;-moz-user-select:none;-ms-user-select:none;user-select:none;border:none;border-radius:0;background:none;font-family:inherit;font-weight:inherit;font-size:inherit;line-height:inherit;color:inherit;width:auto;cursor:pointer;-webkit-text-decoration:none;text-decoration:none;-webkit-box-flex-wrap:nowrap;-webkit-flex-wrap:nowrap;-ms-flex-wrap:nowrap;flex-wrap:nowrap;text-align:left;font-size:inherit;line-height:inherit;background-color:transparent;color:#2c2d2f;font-size:16px;line-height:24px;width:auto;display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;}a.css-fp7fcu{-webkit-user-select:auto;-moz-user-select:auto;-ms-user-select:auto;user-select:auto;}button.css-fp7fcu{-webkit-user-select:none;-moz-user-select:none;-ms-user-select:none;user-select:none;}.css-fp7fcu:hover,.css-fp7fcu[data-hover]{-webkit-text-decoration:underline;text-decoration:underline;}.css-fp7fcu:hover,.css-fp7fcu:focus,.css-fp7fcu[data-focus]{background-color:transparent;color:#2c2d2f;}.css-fp7fcu:focus,.css-fp7fcu[data-focus]{outline:2px solid #7e9bf0;}.css-fp7fcu:active,.css-fp7fcu[data-active]{background-color:transparent;color:#2c2d2f;}.css-fp7fcu:disabled,.css-fp7fcu[disabled]{background:transparent;border-color:transparent;color:#8f9197;}.css-fp7fcu:disabled,.css-fp7fcu[disabled]{cursor:not-allowed;-webkit-text-decoration:none;text-decoration:none;}.css-1lzvamb{-webkit-align-items:baseline;-webkit-box-align:baseline;-ms-flex-align:baseline;align-items:baseline;margin:0;padding:0;-webkit-appearance:none;-moz-appearance:none;-ms-appearance:none;appearance:none;-webkit-user-select:none;-moz-user-select:none;-ms-user-select:none;user-select:none;border:none;border-radius:0;background:none;font-family:inherit;font-weight:inherit;font-size:inherit;line-height:inherit;color:inherit;width:auto;cursor:pointer;-webkit-text-decoration:none;text-decoration:none;-webkit-box-flex-wrap:nowrap;-webkit-flex-wrap:nowrap;-ms-flex-wrap:nowrap;flex-wrap:nowrap;text-align:left;font-size:inherit;line-height:inherit;background-color:transparent;color:#2c2d2f;font-size:16px;line-height:24px;width:auto;display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;position:relative;z-index:1;}a.css-1lzvamb{-webkit-user-select:auto;-moz-user-select:auto;-ms-user-select:auto;user-select:auto;}button.css-1lzvamb{-webkit-user-select:none;-moz-user-select:none;-ms-user-select:none;user-select:none;}.css-1lzvamb:hover,.css-1lzvamb[data-hover]{-webkit-text-decoration:underline;text-decoration:underline;}.css-1lzvamb:hover,.css-1lzvamb:focus,.css-1lzvamb[data-focus]{background-color:transparent;color:#2c2d2f;}.css-1lzvamb:focus,.css-1lzvamb[data-focus]{outline:2px solid #7e9bf0;}.css-1lzvamb:active,.css-1lzvamb[data-active]{background-color:transparent;color:#2c2d2f;}.css-1lzvamb:disabled,.css-1lzvamb[disabled]{background:transparent;border-color:transparent;color:#8f9197;}.css-1lzvamb:disabled,.css-1lzvamb[disabled]{cursor:not-allowed;-webkit-text-decoration:none;text-decoration:none;}Small Business. A high interest coverage ratio, on the other hand, indicates that theres enough revenue to cover loans properly. Great!

An undeniable fact of running a small business is that at some point the company will have to take out a loan to advance its operations. Youll need to know how to calculate interest expense to put together your business income statement.

Like other expenses, you can list interest expense deductions on your tax return.

Interest expense, as previously mentioned, is the money a business owes after taking out a loan. The interest expense account is always debited. The period is written as 0.25 because its one quarter of the year in relation to the 5% annual interest rate. "Topic No. An accountant for Company ABC is drawing up its financial statements for the first quarter of 2021 and wants to know the interest expense for this three-month period. Plug the principal, interest rate, and period into the interest expense formula, which well share below. Since its a liability, interest payable accounts are recorded on the balance sheet and are due by the end of the accounting year or operating cycle. Interest rates are typically lower for these types of loans. Over 70,000 businesses use GoCardless to get paid on time. And since usually we dont pay for interest expenses right away, the other account part of the journal entry is interest payable, which is a liability account representing the debt. See Also: GoCardless can help, .css-1fbt1mu{-webkit-align-items:baseline;-webkit-box-align:baseline;-ms-flex-align:baseline;align-items:baseline;margin:0;padding:0;-webkit-appearance:none;-moz-appearance:none;-ms-appearance:none;appearance:none;-webkit-user-select:none;-moz-user-select:none;-ms-user-select:none;user-select:none;border:none;border-radius:0;background:none;font-family:inherit;font-weight:inherit;font-size:inherit;line-height:inherit;color:inherit;width:auto;cursor:pointer;-webkit-text-decoration:none;text-decoration:none;-webkit-box-flex-wrap:nowrap;-webkit-flex-wrap:nowrap;-ms-flex-wrap:nowrap;flex-wrap:nowrap;display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;-webkit-box-pack:center;-ms-flex-pack:center;-webkit-justify-content:center;justify-content:center;font-weight:600;text-align:center;border-radius:calc(12px + 24px);color:#f3f4f5;background-color:#5f24d2;-webkit-transition:border 150ms,background 150ms,-webkit-transform 100ms ease-in-out;transition:border 150ms,background 150ms,transform 100ms ease-in-out;border:1px solid #5f24d2;padding:8px 32px;font-size:16px;line-height:24px;width:auto;display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;}a.css-1fbt1mu,button.css-1fbt1mu{-webkit-user-select:none;-moz-user-select:none;-ms-user-select:none;user-select:none;}.css-1fbt1mu:hover,.css-1fbt1mu:focus,.css-1fbt1mu[data-hover],.css-1fbt1mu[data-focus]{color:#f3f4f5;background-color:#875add;border-color:#875add;}.css-1fbt1mu:focus,.css-1fbt1mu[data-focus]{outline:none;box-shadow:0 0 0 2px #c7b2ef;}.css-1fbt1mu:focus:not(:focus-visible){box-shadow:none;}.css-1fbt1mu:active,.css-1fbt1mu[data-active]{color:#f3f4f5;background-color:#4c1ca8;border-color:#4c1ca8;-webkit-transform:scale(.985, .985);-moz-transform:scale(.985, .985);-ms-transform:scale(.985, .985);transform:scale(.985, .985);}.css-1fbt1mu.css-1fbt1mu:disabled,.css-1fbt1mu.css-1fbt1mu[disabled]{background-color:#e4e5e7;border-color:#e4e5e7;color:#8f9197;}.css-1fbt1mu:disabled,.css-1fbt1mu[disabled]{cursor:not-allowed;-webkit-text-decoration:none;text-decoration:none;}.css-11qjisw{-webkit-flex:1 1 auto;-ms-flex:1 1 auto;flex:1 1 auto;}Contact sales, .css-1cqmfhn{-webkit-flex-basis:100%;-ms-flex-preferred-size:100%;flex-basis:100%;display:block;padding-right:0px;padding-bottom:16px;}.css-1cqmfhn+.css-1cqmfhn{display:none;}Sales, .css-1t3fsxj{-webkit-align-items:baseline;-webkit-box-align:baseline;-ms-flex-align:baseline;align-items:baseline;margin:0;padding:0;-webkit-appearance:none;-moz-appearance:none;-ms-appearance:none;appearance:none;-webkit-user-select:none;-moz-user-select:none;-ms-user-select:none;user-select:none;border:none;border-radius:0;background:none;font-family:inherit;font-weight:inherit;font-size:inherit;line-height:inherit;color:inherit;width:auto;cursor:pointer;-webkit-text-decoration:none;text-decoration:none;-webkit-box-flex-wrap:nowrap;-webkit-flex-wrap:nowrap;-ms-flex-wrap:nowrap;flex-wrap:nowrap;text-align:left;font-size:inherit;line-height:inherit;background-color:transparent;color:#fbfbfb;font-size:14px;line-height:20px;width:auto;display:inline;}a.css-1t3fsxj{-webkit-user-select:auto;-moz-user-select:auto;-ms-user-select:auto;user-select:auto;}button.css-1t3fsxj{-webkit-user-select:none;-moz-user-select:none;-ms-user-select:none;user-select:none;}.css-1t3fsxj:hover,.css-1t3fsxj[data-hover]{-webkit-text-decoration:underline;text-decoration:underline;}.css-1t3fsxj:hover,.css-1t3fsxj:focus,.css-1t3fsxj[data-focus]{background-color:transparent;color:#fbfbfb;}.css-1t3fsxj:focus,.css-1t3fsxj[data-focus]{outline:2px solid #7e9bf0;}.css-1t3fsxj:active,.css-1t3fsxj[data-active]{background-color:transparent;color:#f3f4f5;}.css-1t3fsxj:disabled,.css-1t3fsxj[disabled]{background:transparent;border-color:transparent;color:#8f9197;}.css-1t3fsxj:disabled,.css-1t3fsxj[disabled]{cursor:not-allowed;-webkit-text-decoration:none;text-decoration:none;}Contact sales, Seen 'GoCardless Ltd' on your bank statement?

You can also find this information on the company debt schedule, which should outline all of the businesss debts along with their balances and interest rates. This might be for the year, month, or a specific accounting period.  She holds a Bachelor of Science in Finance degree from Bridgewater State University and has worked on print content for business owners, national brands, and major publications. If you want to increase the value of your organization, thenclick here to download the Know Your Economics Worksheet. In corporate finance, the debt-service coverage ratio (DSCR) is a measurement of the cash flow available to pay current debt obligations. "Income Tax Folio S3-F6-C1, Interest Deductibility.". Heavily indebted companies may have a hard time serving their debt loads during economic downturns. Learn more about how you can improve payment processing at your business today. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. Why Do Shareholders Need Financial Statements? However, some businesses choose to list this expense in the SG&A (Selling, General, & Administrative) section instead. The former editor of. Interest Expense Formula

She holds a Bachelor of Science in Finance degree from Bridgewater State University and has worked on print content for business owners, national brands, and major publications. If you want to increase the value of your organization, thenclick here to download the Know Your Economics Worksheet. In corporate finance, the debt-service coverage ratio (DSCR) is a measurement of the cash flow available to pay current debt obligations. "Income Tax Folio S3-F6-C1, Interest Deductibility.". Heavily indebted companies may have a hard time serving their debt loads during economic downturns. Learn more about how you can improve payment processing at your business today. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. Why Do Shareholders Need Financial Statements? However, some businesses choose to list this expense in the SG&A (Selling, General, & Administrative) section instead. The former editor of. Interest Expense Formula

Deskera allows you to automate your recurring invoice payments with just a few clicks. [box]Strategic CFO Lab Member Extra Interest payable, on the other hand, is a current liability for the part of the loan that is currently due but not yet paid. The best part? Investopedia does not include all offers available in the marketplace. Access your Strategic Pricing Model Execution Plan in SCFO Lab.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. This type of expense can be interest payments on loans, bonds, or other debt instruments. Click hereto access your Execution Plan. It is essentially calculated as the interest rate times the outstanding principal amount of the debt. An interest expense is an accounting item that is incurred due to servicing debt. Jump Start Your Growing Business with Deskera. Although the word expense is in their title, they are recorded as assets on the balance sheet. So, during the first quarter of 2021, the company paid $937.50 in interest expense and can list this on its income statement. ", Government of Canada. Be sure to consult with a financial advisor to find the most advantageous rate and repayment schedule. Interest payable is therefore credited. However, there are restrictions even on such tax-deductibility. Using just one formula, you can find out the interest expense by multiplying the principal amount by the interest rate and then multiply by .25 (as in, one quarter-year): Interest Expense = $90,000 10% 0.25 = $2,250. Its recorded as an expense in the income statement. On the other hand, during periods of muted inflation, interest expense will be on the lower side. That is because one thing that all Entrepreneurs have in common is that they must file a tax return. If these processes arent done correctly, they could lead to tense businessrelationships with clients and suppliers, cash flow issues, and even riskexposure to lawsuits., Common Accounting Errors - A Practical Guide With Examples, When running your own business finances, youll likely make accounting errorsfrom time to time. Record it in a liabilities account, if it was accrued prior to being paid. .css-y3jkrv{-webkit-align-items:baseline;-webkit-box-align:baseline;-ms-flex-align:baseline;align-items:baseline;margin:0;padding:0;-webkit-appearance:none;-moz-appearance:none;-ms-appearance:none;appearance:none;-webkit-user-select:none;-moz-user-select:none;-ms-user-select:none;user-select:none;border:none;border-radius:0;background:none;font-family:inherit;font-weight:inherit;font-size:inherit;line-height:inherit;color:inherit;width:auto;cursor:pointer;-webkit-text-decoration:none;text-decoration:none;-webkit-box-flex-wrap:nowrap;-webkit-flex-wrap:nowrap;-ms-flex-wrap:nowrap;flex-wrap:nowrap;text-align:left;font-size:inherit;line-height:inherit;background-color:transparent;color:#fbfbfb;font-size:16px;line-height:24px;width:auto;display:inline;}a.css-y3jkrv{-webkit-user-select:auto;-moz-user-select:auto;-ms-user-select:auto;user-select:auto;}button.css-y3jkrv{-webkit-user-select:none;-moz-user-select:none;-ms-user-select:none;user-select:none;}.css-y3jkrv:hover,.css-y3jkrv[data-hover]{-webkit-text-decoration:underline;text-decoration:underline;}.css-y3jkrv:hover,.css-y3jkrv:focus,.css-y3jkrv[data-focus]{background-color:transparent;color:#fbfbfb;}.css-y3jkrv:focus,.css-y3jkrv[data-focus]{outline:2px solid #7e9bf0;}.css-y3jkrv:active,.css-y3jkrv[data-active]{background-color:transparent;color:#f3f4f5;}.css-y3jkrv:disabled,.css-y3jkrv[disabled]{background:transparent;border-color:transparent;color:#8f9197;}.css-y3jkrv:disabled,.css-y3jkrv[disabled]{cursor:not-allowed;-webkit-text-decoration:none;text-decoration:none;}Learn more, GoCardless Ltd., 333 Bush St 4th Floor, San Francisco, CA 94104, USA. To learn more about payables and how to record them as journal entries, head over to our accounts payable guide. In Canada, for instance, if the loan is taken out for an investment that is held in a registered accountsuch as aRegistered Retirement Savings Plan (RRSP), Registered Education Savings Plan(RESP) or Tax-Free Savings Accountinterest expense is not permitted to be tax-deductible.