cryptocurrency market trends

Many developed and emerging economies have started pondering the potential of usingdigital ledger technologyfor financial transactions.  The global cryptocurrency market is predicted to be valued at US$ 46.2 Bn by 2032. United States, by Fact.MR , a division of Eminent Research and Advisory Services. 2022, Nasdaq, Inc. All Rights Reserved. The introduction of advanced micro devices has also created immense opportunities for the regional players in specific domains. Your personal details are safe with us. This development in the financial system is anticipated to create a remarkable shift in the perception ofcryptocurrency coinsby general people. | Source:

The major focus of the market players in the current global scenario is capturing retail peer-to-peer payment systems compatible to crypto wallets. What are the main roadblocks or barriers to crypto becoming more mainstream? We alsospotlight must-see TradeTalks videos from the past week. Which Region Accounts for the largest Revenue Share in the Cryptocurrency Market? The amount of money coming into the space and making new projects happen is incredible. Are there trends in the crypto space that investors should be paying more attention to right now? What was the Historical Size of the Cryptocurrency Market? North America acquires the dominant share of the total revenue generated through cryptocurrency transactions. This is predicted to increase the validation of cryptocurrencies in other retail and e-commerce payments through online platforms. Blockchain used in cryptocurrency transactions or thecrypto ledgerhas established the foundation for the cryptocurrency market and is expected to be a growing sub-segment over the forecast years. North America accounts for the largest revenue share in the global cryptocurrency market with US alone accounting for up to 31% of the total revenue.

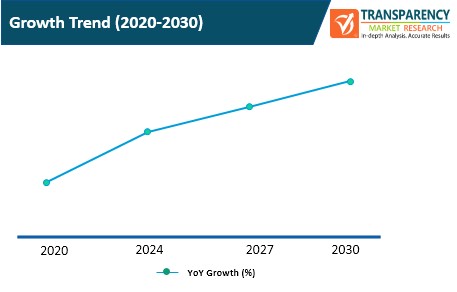

The global cryptocurrency market is estimated to record a CAGR of 31.3% during the forecast period.

The global cryptocurrency market is predicted to be valued at US$ 46.2 Bn by 2032. United States, by Fact.MR , a division of Eminent Research and Advisory Services. 2022, Nasdaq, Inc. All Rights Reserved. The introduction of advanced micro devices has also created immense opportunities for the regional players in specific domains. Your personal details are safe with us. This development in the financial system is anticipated to create a remarkable shift in the perception ofcryptocurrency coinsby general people. | Source:

The major focus of the market players in the current global scenario is capturing retail peer-to-peer payment systems compatible to crypto wallets. What are the main roadblocks or barriers to crypto becoming more mainstream? We alsospotlight must-see TradeTalks videos from the past week. Which Region Accounts for the largest Revenue Share in the Cryptocurrency Market? The amount of money coming into the space and making new projects happen is incredible. Are there trends in the crypto space that investors should be paying more attention to right now? What was the Historical Size of the Cryptocurrency Market? North America acquires the dominant share of the total revenue generated through cryptocurrency transactions. This is predicted to increase the validation of cryptocurrencies in other retail and e-commerce payments through online platforms. Blockchain used in cryptocurrency transactions or thecrypto ledgerhas established the foundation for the cryptocurrency market and is expected to be a growing sub-segment over the forecast years. North America accounts for the largest revenue share in the global cryptocurrency market with US alone accounting for up to 31% of the total revenue.

The global cryptocurrency market is estimated to record a CAGR of 31.3% during the forecast period.

Establishment of data centers at various locations has increased the reliability of Cloud services. Global Cryptocurrency Market Value (2022), Global Cryptocurrency Market Value (2032), Global Cryptocurrency Market Growth Rate (2022-2032), Cryptocurrency Market Share of Top 5 Countries.  What are the Major Challenges Faced by the Cryptocurrency Market Players? There is a major concern over using this retail peer-to-peer payment technology by non-state organizations. These dimensions are projected to increase worldwide market growth. Luna was supposed to succeed because of the returns and the hype, but once that collapsed, there was nothing left. Crypto as a whole raised $25 billion last year. Some of the othertop crypto wallets,including Ethereum, Litecoin, and Dogecoin, are also expected to contribute significantly to the growth of the crypto market. During the projected timeline, Bitcoin is expected to have the highest market share. In March 2021 for accepting cryptocurrency as a payment method.

What are the Major Challenges Faced by the Cryptocurrency Market Players? There is a major concern over using this retail peer-to-peer payment technology by non-state organizations. These dimensions are projected to increase worldwide market growth. Luna was supposed to succeed because of the returns and the hype, but once that collapsed, there was nothing left. Crypto as a whole raised $25 billion last year. Some of the othertop crypto wallets,including Ethereum, Litecoin, and Dogecoin, are also expected to contribute significantly to the growth of the crypto market. During the projected timeline, Bitcoin is expected to have the highest market share. In March 2021 for accepting cryptocurrency as a payment method.  But with the huge growth in assets under management and the many innovations in this space, were seeing some really big players coming over from traditional tech for the first time from companies like Amazon (AMZN), Apple (AAPL) and Meta (FB). June 03, 2022 04:56 ET

Type a symbol or company name. I think it's time to look at the fundamentals of crypto projects and start moving away from projects that use inflated returns to drive up the value of the protocol. The benefits of cryptocurrency payments include improved transactional security, security from fraud, a decentralized system, low fees, and consumer protection fees, and rapid international transactions. As well as the ongoing research works carried out in the field of data management and Blockchains are predicted to boost theglobal cryptocurrency currency market sharein the economic scenario of the world. However, the lack of financial literacy and awareness about the various digital technologies among ordinary people only limits thecrypto ledgerin rich societies. These machines used in coin mining have sufficiently increased the volume of various cryptocurrencies that are predicted to drive the global market further. During the projected timeline, APAC ought to have the highest share in the total market for cryptocurrency. In coming years, such parameters could influence the crypto-currency market.RestraintLack of RegulationThere is still no regulation of the cryptocurrency market. What is the Covid-19 Impact on Global Cryptocurrency Market? Increased adoption of bitcoins in developing countries, greater investment in blockchain technology, and increased demand for secure international-border transactions are alleged to provide favorable prospects for advances in the cryptocurrency industry.Global Cryptocurrency: SegmentsBitcoins segment to grow with the highest CAGR during 2020-30Global Cryptocurrency is segmented by Product Type into Bitcoin and Altcoins. The significant impact positive impact was the growth of knowledge about the cryptocurrency coins among the greater mass. Due to favorable government structures, Japan and Singapore are the booming markets in terms of total traffic over digital currency exchange platforms. Stuart Popejoy, Co-Founder and CEO of Kadena, talks about the three trends that show the crypto market is poised for continued growth, as well as how crypto investors may want to evaluate stablecoin Terras recent crash.

But with the huge growth in assets under management and the many innovations in this space, were seeing some really big players coming over from traditional tech for the first time from companies like Amazon (AMZN), Apple (AAPL) and Meta (FB). June 03, 2022 04:56 ET

Type a symbol or company name. I think it's time to look at the fundamentals of crypto projects and start moving away from projects that use inflated returns to drive up the value of the protocol. The benefits of cryptocurrency payments include improved transactional security, security from fraud, a decentralized system, low fees, and consumer protection fees, and rapid international transactions. As well as the ongoing research works carried out in the field of data management and Blockchains are predicted to boost theglobal cryptocurrency currency market sharein the economic scenario of the world. However, the lack of financial literacy and awareness about the various digital technologies among ordinary people only limits thecrypto ledgerin rich societies. These machines used in coin mining have sufficiently increased the volume of various cryptocurrencies that are predicted to drive the global market further. During the projected timeline, APAC ought to have the highest share in the total market for cryptocurrency. In coming years, such parameters could influence the crypto-currency market.RestraintLack of RegulationThere is still no regulation of the cryptocurrency market. What is the Covid-19 Impact on Global Cryptocurrency Market? Increased adoption of bitcoins in developing countries, greater investment in blockchain technology, and increased demand for secure international-border transactions are alleged to provide favorable prospects for advances in the cryptocurrency industry.Global Cryptocurrency: SegmentsBitcoins segment to grow with the highest CAGR during 2020-30Global Cryptocurrency is segmented by Product Type into Bitcoin and Altcoins. The significant impact positive impact was the growth of knowledge about the cryptocurrency coins among the greater mass. Due to favorable government structures, Japan and Singapore are the booming markets in terms of total traffic over digital currency exchange platforms. Stuart Popejoy, Co-Founder and CEO of Kadena, talks about the three trends that show the crypto market is poised for continued growth, as well as how crypto investors may want to evaluate stablecoin Terras recent crash.

How should crypto investors evaluate Terras recent crash? The strong growth in the cryptocurrency market is driven by the expectation that Bitcoin will be "digital gold" and that blockchain-based tokens will reshape industries.Payment segment to grow with the highest CAGR during 2020-30Global Cryptocurrency is divided by Application into Peer-to-Peer Payment, Retail, Trading, Remittance, E-commerce, and Payment. Outsmart the market with Smart Portfolio analytical tools powered by TipRanks. ReportLinker

How should crypto investors evaluate Terras recent crash? The strong growth in the cryptocurrency market is driven by the expectation that Bitcoin will be "digital gold" and that blockchain-based tokens will reshape industries.Payment segment to grow with the highest CAGR during 2020-30Global Cryptocurrency is divided by Application into Peer-to-Peer Payment, Retail, Trading, Remittance, E-commerce, and Payment. Outsmart the market with Smart Portfolio analytical tools powered by TipRanks. ReportLinker

Though the significant driving factor of the cryptocurrency market is the retail peer-to-peer payment over online platforms, the reduction in personal income resulted in lesser attraction for any investment in digital assets.

Over the last few years, severalcryptocurrency walletshave been released by many market players under different names. What is the projected Value of Cryptocurrency Market By 2032? In March alone, crypto startups in infrastructure, NFTs and gaming received more than $3.5 billion in VC cash a record high. 6 Design Principles for a Successful Central Bank Digital Currency, Here Are the Top Five Cryptocurrencies You've Never Heard Of, Do Not Sell My Personal Information (CA Residents Only). Emergence of new online marketing enterprises are driving the regional markets. The prominent advantage of a cryptocurrency over the traditional money bills and digital payment systems is the transparency in spending crypto through crypto-ledger technology. Meanwhile, the projects that have weathered the storm have done so because their value comes from their differentiation or execution in infrastructure and services, for example. Such initiatives by market players and government policies are expected to boost the global cryptocurrency market during the forecast year and ahead. The market analysis report shows that thedemand for cryptocurrency coinsis expected to boost significantly due to the government backing of such technologies. Sign up today for your free Reader Account.

Why are crypto prices falling? Building trust among users by establishing real-time data dissemination mechanism. As the cryptocurrency market is still in its development phase, thecryptocurrency mining rigsare the essential components in present times. A new payment system has been introduced by Visa Inc. With the growth of the number of users, the digital currency exchange facilities are expected to gain more legitimacy creating a favorable outlook for the cryptocurrency market. This interview originally appeared in our TradeTalks newsletter.

The global cryptocurrency market is predicted to grow at a robust CAGR of 31.3%. Use of quantu AI and Automation in Banking Market is projected to reach USD 182 Bn by 2032. Stuart Popejoy, Co-Founder and CEO of Kadena, talks about the three trends that show the crypto market is poised for continued growth, as well as how crypto investors may want to evaluate stablecoin Terras recent crash.

Find market research and analysis that is reliable and actionable. This new service has been designed to process cryptocurrency payments on Ethereum blockchain directly. Different national governments or central banks have already published their cryptocurrencies for global transactions. What Is the Next Big Cryptocurrency To Explode in 2022? This fact is expected to be a major restraint for the growth of the global cryptocurrency market for some more years ahead. This can be evident from the shift in attitude towards cryptocurrency investments in post-pandemic years that is predicted to drive the global market. Reportlinker finds and organizes the latest industry data so you get all the market research you need - instantly, in one place.__________________________, https://www.reportlinker.com/p06191821/?utm_source=GNW. These variables help to increase crypto-currency adoption rates.Global Cryptocurrency Market DynamicsDriversBlockchain reduces the cost of ownershipThe principle of blockchain and cryptography is used by cryptocurrency transactions.

So the development of software by emerging start-ups is predicted to drive the crypto market at ground level.. This is a correction that follows the buildup of last year, no different than how tech is correcting after its huge growth during the early period of the pandemic.

The global cryptocurrency market was valued at US$ 2.3 Bn in 2021. There are still too many security and scalability problems with now-legacy platforms, and the consequences have been losses in the hundreds of millions. This is just the beginning. The development of efficient hardware or computers and high-speed internet facility has resulted in the establishment of super crypto mining machines. Which Region has the Highest Potential of Growth for the Global Cryptocurrency Market? This isn't crypto's first bear market and won't be its last. Shift in business by shifting workspace from office to work from home models. Bitcoin is still regarded as thebest crypto to mineowing to its robust networks established across the globe. Despite all the advantages of using digital ledger technology and cryptocurrencies, the acceptability of cryptocurrencies is not widespread. Blockchain is a kind of distributed ledger system that provides greater security in real-time for the digital economic process. Originally in crypto, you really only had cryptographers and similar specialists getting involved. A comprehensive business intelligence repository that covers established as well as evolving market trends. Dublin 2, Ireland, 11140 Rockville Pike, Suite 400, Rockville, MD 20852, How Strong is the Competitive Landscape for the Global Cryptocurrency Market? Type a symbol or company name.

This renders the hardware segmentdominant in the overall market size. Speculations over financial institutions and government intervention in the financial market are anticipated to be the primary reason for the growing popularity of cryptocurrency coins.

We go beyond one sector, and analyze the market from various perspectives. Asia Pacific region is predicted to witness the highest CAGR in the cryptocurrency market with Japan recording the highest CAGR of 34.6% through 2032. The untapped potential of distributed Blockchain technology in several other fields of operation can create immense opportunities fordigital currency exchangefacilities in the coming days. Formulation of favorable regulations by various national governments is predicted to drive the demand. The most popular among the different sub-segments of the hardware components used ina crypto mining rig for saleis based on processor ASICs, GPU, and FPGAs. Blockchain offers a robust information-sharing platform. Fidelity 401Ks now make it possible for mainstream investors to acquire Bitcoin. This market has been segmented into China, Japan, South Korea, and APACs Rest (RoAPAC). Bitcoin was the pioneer of this technology and, surprisingly enough, still holds a significant share of theglobal cryptocurrency marketand is estimated to turn around into a US$ Bn economy by the year 2032. It is estimated to be valued at about US$ 31.2 Bn by the end of this forecast year by recording a CAGR of 30.8%.

What is the Growth Outlook of the Cryptocurrency Market? Additionally, Bitcoin (BTC) was directly implicated in the Terra debacle. By technology, natural Blockchain Technology Market is expected to register a CAGR of 84% by 2032. Fact.MRs industry-wide market research solutions are comprehensive. China is the nations biggest APAC market. Despite falling prices, do you see crypto becoming mainstream? Sign uphereto access exclusive market analysis by a new industry expert each week. Ambiguity in its regulation by national and international organizations has presented a lot of uncertainty regarding cryptocurrency coins in the recent past. The mining process holds a significant share of the cryptocurrency market among all the sub-segment of the software for cryptocurrency trading.

These include North America, Latin America, Europe, Asia Pacific, and the Middle East and Africa.

The lack of regulations and instability about it are currently one of the main restrictive factors of crypto-monetary adoption. Third, penetration of crypto assets is increasing. Comparative View of Adjacent Global Cryptocurrency Market, Comparative View of Adjacent Global Cloud Services Market, Comparative View of Adjacent Global Digital Assets Market. Avail customized purchase options for your needs, End users who buy crypto over online platforms completely rely upon the capability of software for trading. Push for digital contents over the online platforms has created a huge demand. Terra was buying Bitcoin to stabilize Luna in the lead-up to the crisis, which caused a large one-time selloff of Bitcoin.

Some of the variables that increase consumer growth globally are low ownership costs, safer, and increased efficiency.

While financial regulators all over the globe work to develop common cryptocurrency guidelines, regulatory recognition continues to be one of the major hurdles for cryptocurrency adoption. Many new players have emerged in the market for with a lot of different types of digital coins. For a better experience for cryptocurrency users, developing robust software solutions is an integral part. Moreover, it is further expected that minimum exchange rates, interest rates, or charges for all international transactions will fuel the cryptocurrency market over the forecast period. What are the Different Market Dynamics driving the Global Cryptocurrency Market? Cryptocurrency greatly reduces cost of ownership, and transfers are much faster and more reliable. It hampers the global market from acquiring more participants, invariably restraining the market from realizing its full potential. Bitcoin alternatives are termed as altcoins. Cryptocurrency, except on-screen numbers representing cryptocurrencies as compared to other currencies such as the dollar, is coarsely the correspondent by using a debit card or PayPal.Market HighlightsGlobal Cryptocurrency is expected to project a notable CAGR of 30.32% in 2030.Global Cryptocurrency market to surpass USD 3474.31 million by 2030 from USD 842.36 million in 2020 at a CAGR of 30.32 % in the coming years, i.e., 2021-30. On the other hand, Covid-19 had some remarkable influence on the global cryptocurrency market as per the market analysis reports. In addition, the cryptocurrency market is anticipated to enhance in the coming years at minimum exchange rates, interest rates, and charges for all international transactions.Distributed ledgerDistributed ledger systems allow a decentralized model of paying for a digital currency system by eliminating the requirement for centralized intermediary processing. Such acceptance of crypto coins is predicted to benefit the cryptocurrency market across the globe.. The use of cryptocurrency wallets on online platforms has become a new trend among youngsters. Due to the improving data transfer infrastructure and digital awareness in the South and South East Asian countries, there has been a considerable increment in the digital currency exchange facilities in the recent past. Improved clarity of information about different types of cryptocurrencies available in the market is expected to be the foremost driving factor for the cryptocurrency market. Several national and international organizations, including some famous business tycoons, have promoted the use of cryptocurrency in the recent past. Three trends show the crypto market is poised for continued growth: Currently, its primarily the blue-chip crypto assets like Bitcoin and Ethereum that are gaining this type of partnership traction, but eventually well see a broader set of DeFi, NFTs and many other assets offered up in new and exciting ways. Copy and paste multiple symbols separated by spaces. TradeTalks is Nasdaqs regular series covering trading news, market trends and education. Crypto is still hobbled by problems that first showed up in 2017. Privacy Policy*, Suite 9884, 27 Upper Pembroke Street, When the symbol you want to add appears, add it to Watchlist by selecting it and pressing Enter/Return. Some Asia Pacific countries have been analyzed to record growth rates higher than the USA in cryptocurrency coins. Crypto walletsprovided by various online cryptocurrency transaction platforms are also a very attractive sub-segment among retail users. It provides virtual tracking and trading of any value by generating digital money. During the pandemic years, the global economic condition got hit, severely disrupting the financial condition of many citizens.

Which Cryptocurrencies are the Top Selling Coins in the Global Market? Cryptocurrency is driven by increasing demand for trade, compliance-free transfer, and simplicity of cross-border payments. Non-Fungible Token (NFT) Market is predicted to grow nearly 12X, reaching a valuation of US$ 316.7 b Quantum Cryptography Market to grow at a CAGR of over 30% during the years, 2021-2031. What is the Regional Analysis of Global Cryptocurrency Market? After the information revolution of this century, there has been a significant investment for developing digit economy. An Adaptive Approach to Modern-day Research Needs. The software is also a prominent segment of the success of theglobal cryptocurrency market. In recent years the popularity of different digital assets has gained momentum against the dwindling government-backed financial markets in many nations. Some of the other issues that have posed a major challenge for the growth of digital currency exchange commodities is the anonymity of the transaction. The global cryptocurrency market is estimated to be valued at US$ 46.2 Bn by 2032 from US$ 2.3 Bn in 2021.

Like any other medium of exchange, cryptocurrencies need a proper backup by an authority for their legitimacy. ReportLinker, New York, June 03, 2022 (GLOBE NEWSWIRE) -- Reportlinker.com announces the release of the report "Cryptocurrency Market Segments by Product Type ; by Application and Region Global Analysis of Market Size, Share & Trends for 2019 2020 and Forecasts to 2030" - https://www.reportlinker.com/p06191821/?utm_source=GNW Bitcoin, bitcoin cash, Ethereum, Ripple, Litecoin, Dash coin, and many more are available in different forms of cryptocurrency. What is the Growth Outlook for the Global Cryptocurrency Market According to Different Segments? The German restaurant chain named Berger King announced to accept Bitcoin as payments in September 2019. Create your Watchlist to save your favorite quotes on Nasdaq.com. Traditional venture capital is flatlining while more money is coming into crypto. Growing popularity among youths to invest in cryptocurrencies. The market in China is anticipated to be the biggest in APAC given the low power bills, the good weather, the existence of major mining enterprises, and the accessibility of venture capital funds.Global Cryptocurrency is further segmented by region into:North America Market Size, Share, Trends, Opportunities, Y-o-Y Growth, CAGR United States and CanadaLatin America Market Size, Share, Trends, Opportunities, Y-o-Y Growth, CAGR Mexico, Argentina, Brazil, and Rest of Latin AmericaEurope Market Size, Share, Trends, Opportunities, Y-o-Y Growth, CAGR United Kingdom, France, Germany, Italy, Spain, Belgium, Hungary, Luxembourg, Netherlands, Poland, NORDIC, Russia, Turkey, and Rest of EuropeAsia Pacific Market Size, Share, Trends, Opportunities, Y-o-Y Growth, CAGR India, China, South Korea, Japan, Malaysia, Indonesia, New Zealand, Australia, and Rest of APACMiddle East and Africa Market Size, Share, Trends, Opportunities, Y-o-Y Growth, CAGR North Africa, Israel, GCC, South Africa, and Rest of MENAGlobal Cryptocurrency Market report also contains analysis on:Cryptocurrency Segments:By Product TypeBitcoinAltcoinsBy ApplicationPeer-to-Peer PaymentRetailTradingRemittanceEcommercePaymentCryptocurrency DynamicsCryptocurrency SizeSupply & DemandCurrent Trends/Issues/ChallengesCompetition & Companies Involved in the MarketValue Chain of the MarketMarket Drivers and RestraintsRead the full report: https://www.reportlinker.com/p06191821/?utm_source=GNWAbout ReportlinkerReportLinker is an award-winning market research solution. Many individuals invest incryptocurrency mining rigsand trade in them as an income source. The slowing down of the global cryptocurrency market reflects the dropping down in growth rate from 32.2% during the years just before the pandemic. Following this development, several crypto trading platforms have evolved over the World Wide Web creating a solid market for facilitating cryptocurrency transactions and generating revenue from it.

As the global cryptocurrency market is almost based on the digital or internet world, the Covid-19 restrictions had some indirect effects on it, if not directly. Most of the digital payment companies operating in cryptocurrencies are based in the USA, which accounted for nearly US$ 681.6 Mn in 2021 as a most of the users prefer to buy crypto with paypal and other US based companies all across the nations, so the regional market is predicted to reach a valuation of US$ 14.5 Bn by the end of this forecast period. A macro breakdown caused by factors including tech stocks struggling, the war in Ukraine and inflation/interest rate worries has precipitated a flight to safety out of more speculative stocks. It has led to the emergence of distributed ledger technology and establishment of the cryptocurrency market over online platforms.. You'll now be able to see real-time price and activity for your symbols on the My Quotes of Nasdaq.com. 3 Trends That Suggest Crypto Market Will Grow. Since distributed leader technology is still in its infancy, it raises numerous issues at national and international levels for regulators and policymakers.Global Cryptocurrency Market: Key PlayersBitfinexCompany Overview, Business Strategy, Key Product Offerings, Financial Performance, Key Performance Indicators, Risk Analysis, Recent Development, Regional Presence, SWOT AnalysisBitPay IncBitfury Group LimitedUnocoin Technologies Private LimitedOKExBitstampCoinbase Inc.Circle Internet Financial LimitedRipple Labs Inc.BitGoOther Prominent PlayersGlobal Cryptocurrency Market: RegionsGlobal Cryptocurrency is segmented based on regional analysis into five major regions. When the symbol you want to add appears, add it to My Quotes by selecting it and pressing Enter/Return. First, theres a huge talent migration from big tech into crypto. Were seeing a downturn with traditional assets as well, which in many ways signifies the maturation of digital assets as they ebb and flow in tandem with the economy. This trend is expected to drive the Asia Pacific cryptocurrency market from 2022 to 2032.

RoAPAC contains Singapore, Thailand, Malaysia, India, New Zealand, and Australia. These symbols will be available throughout the site during your session. Where do you see crypto adoption really picking up? Platforms like Kadena are working hard to fix this by bringing new solutions with scalability and safety built in. Distributed headline technology enables tracking of financial transactions. Also, the higher cost associated with crypto mining rigs limits the availability of such coins over digital platforms sufficient amount. The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc. Sign up to receive your weekly dose of trading news, trends and education. Provision of high security data processing and management to attract more users. With the development of distributed ledger technology, cryptocurrencies, such as Bitcoin, Ethereum, and others, are favored for online value and money transactions.

Japan is projected to witness the highest CAGR of 34.6% over the forecast years. Second, institutional funding is shifting to crypto projects. Prominent market players are also trying to collaborate as a strategy to include bank account features with the mobile wallet options. With the development of sufficient infrastructure, any possibility of fraud and hacking threats can be eliminated duringretail peer-to-peer-to-peer paymentsand remittance transactions.