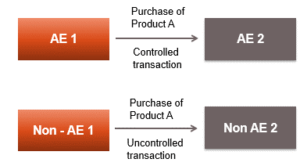

related party transaction example

12. Usage explanations of natural written and spoken English. In order to prevent risks associated with related party []. Then investigate any abnormal transactions outside the normal course of business, especially if they involve round-dollar amounts (e.g., $350,000). Gross Profit Method Impact of overstating the gross profit %, 3 Reasons to use Universal CPA as a supplement for the CPA exam.

The bonus enables the CEO to buy his wife a new Tesla and the CFO to take a one-month trip to Europe.

Parrot Corporation holds a 42 percent ownership of Sunrise, Inc. F Co. is a domestic firm in which D Corp. owned 60% and E, Lee sells equipment (basis $10,000) to related party, Lee Construction Inc., for $6,000. Auditors consider a fraud triangle model, which focuses on three components: incentive/pressure, rationalization, and opportunity. The definitions of a related party are broadly similar, and industry standards require that the nature of the relationship, a description of the transaction, and the amounts involved (including outstanding balances) be disclosed for related-party transactions. B. - Definition & Concept, Tech and Engineering - Questions & Answers, Health and Medicine - Questions & Answers, Question 18 (1 point) Question 18 Unsaved Which of the following persons is not a "family member" for purposes of the related party rules? During 2014, USAco, a domestic corporation, forms a Canadian subsidiary, CANco, to distribute USAco's widgets in Canada. While these transactions are not illegal, the reporting and disclosure requirements, if not followed, can result in significant fines and penalties, and create a red flag for investors. Management performs the trick on December 27th, and soon they are toasting drinks in the back room. Auditors are then required to communicate to the company's audit committee an evaluation of the company's completeness in identifying, accounting for, and disclosing relationships with its related parties. Related Party Transactions: Definition & Examples, Related Parties in Accounting: Examples & Analysis, Subsequent Events Disclosure: Example & Analysis, Identifying Accounting Errors: Types & Importance, The Lower of Cost or Market of Inventory: Definition & Method, The Seven Steps of Activity-Based Costing, Restating Financial Statements: Purpose, Rules & Process. Additionally, electronically search company receipts, payments, and journal entry descriptions using the related party names. b. Additionally, I frequently speak at continuing education events. Get my free accounting and auditing digest with the latest content. Doing business with a related party does not necessarily require that a company have a different process to manage those transactions but rather that they have internal controls in place to mitigate risk and fraud. Related party transactions are typical and often expected. CoCo Internal Control Framework: Definition & Key Concepts, Interest Rate Parity, Forward Rates & International Fisher Effect, Accounting for Non-Interest & Interest-Bearing Notes, Calculating Performance Materiality & Tolerable Misstatements, How to Calculate Materiality for Financial Statements, The Purpose of Notes on Financial Statements, Recalculation & Reperformance in Audit & Non-Audit Engagements, COSO's Internal Control Framework | Objective, Coverage, and Activities, Introduction to Business: Homework Help Resource, WEST Business & Marketing Education (038): Practice & Study Guide, Hospitality 101: Introduction to Hospitality, DSST Money & Banking: Study Guide & Test Prep, Praxis Business Education (5101): Practice & Study Guide, CSET Business Subtest I (175): Practice & Study Guide, CSET Business Subtest II (176): Practice & Study Guide, CSET Business Subtest III (177): Practice & Study Guide, ILTS Business, Marketing, and Computer Education (171): Test Practice and Study Guide, Introduction to Management: Help and Review, DSST Human Resource Management: Study Guide & Test Prep, Introduction to Human Resource Management: Certificate Program, Create an account to start this course today. So they develop a related party transaction whereby a commonly owned company pays their business $350,000 for bogus reasons--what auditors call a transaction outside the normal course of business.

In considering related party transactions, know that they are more likely with smaller entities, especially when one person owns several entities. A related party transaction is when the company has a transaction with another party that has a pre-existing relationship with the company. Would a company pay that much for the services or products received? copyright 2003-2022 Study.com. The party is a key management member or a parent company's key management member. Liabilities in Accounting Overview & Examples | What Is Liability? What is the Difference Between Legal & Ethical Standards? What are deferred inflows and outflows in encumbrance accounting? All other audits are subject to the American Institute of Certified Public Accountants Auditing Standard Section 550 (AU-C 550, Related Parties). The equity method is being applied. Other additional disclosures that are required include concentration of credit risk and contingencies. Related parties can sometimes be a topic of confusion and gray area. Lastly, all human beings have the potential to rationalize unethical behavior, and executive officers are no exception to this rule. The form is completed on an annual basis, at a minimum, by the related parties. The fact that executive and financial officers hold accountability for the financial reporting also gives them the opportunity to engage in fraudulent reporting activities.

And, by the way, having the client sign a management representation letter saying the transaction is legitimate does not absolve the auditor. Either method can magically create millions in fraudulent revenue. Thats why we help make the complex simple, so you can grow confidently. An error occurred trying to load this video. Imagine this scene. Again, we as auditors need to understand the goals and incentives of the company to understand how and why fraud might occur. When we consider a related-party transaction, the fact that these parties are not fully independent of one another lends itself to tighter controls and full disclosure. When companies do business with related parties, those whom they have a relationship with prior to the transaction, there is a requirement for disclosure as to the nature of the relationship and details of the transactions. The party could be a partner, colleague, or associate of the company. Bonds are retired for consolidated statement purposes only. Most entities have put into practice the use of a related interest form or questionnaire to document related party relationships and transactions. Related party transactions which affect the financial statements. The CEO and CFO might hide the bogus transaction, but, hopefully, the cash receipts supervisor will not. At YHB we understand the complexities that come with running a community bank. Click the "buy now" button to see the book on Amazon.

Preparation of Financial Statements & Compilation Engagements. E Co. is a domestic firm in which D Corp. owned a 90% interest 2. The related party disclosure should include the reason the other entity is a related party and the amount of the transactions. I would definitely recommend Study.com to my colleagues.

The $4,000 loss is: Deductible by Lee on his individual return. A. |

| {{course.flashcardSetCount}} In another example, a business buys property from a board member or from the owner. At present, it looks as if the business is just short, with an expected net income of $9.7 million. Not deductible by Lee but Lee Construction has, Bricks Inc. purchases land for a new factory from Proform Corp. The CEO and CFO might hide the bogus transaction, but, hopefully, the cash receipts supervisor will not. Bil, Miriam gifted property to her brother Aaron on January 25, 2016 at which time it had a fair market value of $35,000. There are several different definitions for related parties, but many are very common: There are many different ways to define a related party, however, financial reporting standards have guidelines that define situations in which a related party must be disclosed. Both standards require the auditor to perform procedures to test the accuracy and completeness of related party transactions. For audits conducted under Public Company Accounting Oversight Board Standards, which includes all SEC registrant audits, Auditing Standard 2410, Related Parties, applies (previously AS 18). 'pa pdd chac-sb tc-bd bw hbr-20 hbss lpt-25' : 'hdn'">. - Definition & Examples, What is Outsourcing? And it was so easy. Most companies have policies and procedures in place to document and disclose related-party transactions. Try refreshing the page, or contact customer support.  The forms are available for revision and updates as necessary throughout the year. He frequently speaks at continuing education events. If you are an SEC registrant, defining immediate family members is more easily interpreted than the ASC 850 definition. The recipr, Which of the following is true with respect to the related party rules? To unlock this lesson you must be a Study.com Member. My sweet spot is governmental and nonprofit fraud prevention. The CEO and CFO receive substantial bonuses if the company's net profit is over $10 million. Whats the main difference between population size and population variability.

The forms are available for revision and updates as necessary throughout the year. He frequently speaks at continuing education events. If you are an SEC registrant, defining immediate family members is more easily interpreted than the ASC 850 definition. The recipr, Which of the following is true with respect to the related party rules? To unlock this lesson you must be a Study.com Member. My sweet spot is governmental and nonprofit fraud prevention. The CEO and CFO receive substantial bonuses if the company's net profit is over $10 million. Whats the main difference between population size and population variability.

She has a master's degree in both Accounting and Project Management. This book will get you there quickly. - Definition & Benefits, What is Payroll Tax? Its a transaction between two parties that have a close association. You might receive some mumbo jumbo explanation for such a payment. Financial institutions are subject to the Federal Reserve Banks Regulation O requirements regarding extensions of credit (loans) to executive officers, directors and principal shareholders. - The Generally Accepted Accounting Principles, Using the Accounting Equation: Analyzing Business Transactions, Typical Problems with Financial Information, Internal Controls in Accounting: Definition, Types & Examples, Limitations of Internal Control in Financial Reporting, The Role of Auditors in the Accounting Process, What is Direct Payment? As you can tell in the above example, you want to be aware of incentives for fraud, such as bonuses or the need to comply with debt covenants. In addition, I consult with other CPA firms, assisting them with auditing and accounting issues. - Definition & Examples, Differential Revenue: Definition, Formula & Example, Differential Income: Definition & Formula, Activity Analysis in Accounting: Definition & Example, Total Landed Cost vs. Total Cost of Ownership, Total Cost of Ownership: Definition, Components & Examples, Total Cost of Ownership: Importance & Benefits, Analyzing Financial Statements: Help & Review, Government-Business Relations: Help & Review, Securities & Anti-Trust Laws: Help & Review, CLEP Introductory Business Law: Study Guide & Test Prep, FTCE Business Education 6-12 (051): Test Practice & Study Guide, Introduction to Public Speaking: Certificate Program, DSST Principles of Public Speaking: Study Guide & Test Prep, Principles of Macroeconomics: Certificate Program, Market-Based Transfer Pricing: Definition & Computation, Cost-Based Transfer Pricing: Definition & Example, Negotiated Transfer Pricing: Definition & Examples, Calculating Direct & Indirect Ownership Percentages for Related-Party Transactions, Small Business Development Center: History & Purpose, Small Business Innovation Research (SBIR): History, Activities & Purpose, Nursing Licensure: Legal Requirements, Revocation, Suspension, and Credentialing, Stress in Nursing: Psychophysiological Adaptations, John Maynard Keynes: Economic Theory & Overview, Monopoly Power: Definition, Sources & Abuse, TExES Science of Teaching Reading (293): Practice & Study Guide, Understanding the Scientific Methods for Research, John F. Kennedy's Accomplishments: Lesson for Kids, Sensory Evaluation of Food: Definition & Types, Bliss by Katherine Mansfield: Characters & Quotes, Hemoglobin: Structure, Function & Impairment, Middlesex Book: Author & Historical References, Quiz & Worksheet - Why Fitzgerald Wrote The Great Gatsby, Quiz & Worksheet - Union States During the Civil War, Quiz & Worksheet - Wiccan Religious History, Quiz & Worksheet - Important World Capitals & Cities, Flashcards - Real Estate Marketing Basics, Flashcards - Promotional Marketing in Real Estate, 7th Grade World History: Enrichment Program, Intro to Criminal Justice: Help and Review, Holt Physical Science Chapter 10: Heat and Heat Technology, Illinois TAP Reading: Summarizing & Interpreting Information, Quiz & Worksheet - Paranoid Personality Disorder Characteristics & Treatment, Quiz & Worksheet - GATT History & Purpose, Quiz & Worksheet - Shakespeare's Sonnet 71, What is a Summary? Thanks for joining me here at CPA Scribo. Requires trend analysis to help determine a capitalization rate OK C. Capitalization rates and d, Working Scholars Bringing Tuition-Free College to the Community. Most companies have an annual review with all employees and require them to submit a related-party transaction screening form to help self-identify these relationships for reporting and auditing purposes. The word in the example sentence does not match the entry word. Add related party transaction to one of your lists below, or create a new one.

No manipulation is occurring.

lessons in math, English, science, history, and more. Related-party transactions provide an opportunity for management to act in their own best interest, which can pose significant risk to the company, including financial reporting misstatement or fraud. As you begin your audit, request a list of all related-party transactions. Materiality Threshold in Accounting Overview & Examples | What is Materiality in Accounting?

I am a practicing CPA and Certified Fraud Examiner. Oftentimes, management approval, significant additional oversight, and internal audit may apply to these transactions, ensuring they follow all legal and ethical guidelines. Then, at year-end, a designated individual performs a review of the forms for completeness and the forms are utilized in the financial reporting disclosure process. 18, Related Parties, on June 24, 2014, requires specific audit procedures for the auditor's evaluation of a company's identification of, accounting for, and disclosure of transactions and relationships between a company and its related parties. - Definition & Laws, What Is Needs Assessment? ASC 850 cites example relationships involved in related party transactions as including: Identification is not always easy; it can be complicated by the interpretations of the language used in the standard. If you see an unusual transaction, request supporting information to determine its legitimacy.

But know this: vague reasons usually imply fraudulent activity. Lori has taught college Finance, Operations and Business courses for over five years. And make sure you interview persons responsible for initiating, approving, or recording transactions. Those responsible for financial reporting should fully understand the disclosure requirements for each reporting agency that has authority to audit their financial statements. Through a tight internal control process and fully disclosing these transactions, companies can help mitigate the risk presented, including financial misstatement and fraud. But in some cases, companies use related party transactions to deceive financial statement readers. I am the quality control partner for our CPA firm where I provide daily audit and accounting assistance to over 65 CPAs. Charles Hall. The second easiest wayexplained in this articleis fraudulent related party transactions. Auditing.

flashcard set{{course.flashcardSetCoun > 1 ?

Each of the governing agencies has published disclosures which further explain the effect of related-party transactions on an organization's financial statements. I once saw a $5 million transaction at year-end, and when I asked for support, the journal entry said, "for prior services provided." 's' : ''}}. 1100 Sunset Lane Suite 1310 P.O. Universal CPA is a visual learning platform that was developed by CPA's to teach future CPA's! Because the business is not performing as well as desired, or maybe the company is not in compliance with debt covenants. Why? So it is possible that related party payments are made to decrease earnings, and then the company might receive the same amount in the future from the related entity. Item 404 of this regulation pertains to transactions with related persons, promoters and certain control persons. So you'll want to know if associated businesses are making payments or loans to commonly owned companies. - Methods & Forms, What Is Equity Financing? Charles Hall is a practicing CPA and Certified Fraud Examiner. - Definition & Example, What is Per Capita Income?

If not, you may need to propose an audit entry to correct the misstatement. Executive officers are in a position to override or manipulate the internal control design and abuse an internal control weakness for their own gain. An example would be if the vice president of marketing for a company recommended their nephew's company to perform services for their organization. succeed. (Noncompliance can trigger a call for repayment, or the loan can become a current liability based on accounting standards.). a. Related-party transactions can occur in many common business transactions. Those can be created without the use of related parties.  {{courseNav.course.mDynamicIntFields.lessonCount}} lessons - Definition, Model & Formula, What is Retail Selling? A taxpayer's uncle is a related party for purposes of Section 267. As a member, you'll also get unlimited access to over 84,000 The SEC's adoption of its newest auditing standard, Auditing Standard (AS) No. In other words, inquire of the CEO and CFO, but also ask questions of others such as the cash receipts or the accounts payable supervisor. Create your account, 13 chapters | Get Your Copy of Audit Risk Assessment Made Easy Click the Book, Get Your Copy of The Why and How of Auditing Click the Book.

{{courseNav.course.mDynamicIntFields.lessonCount}} lessons - Definition, Model & Formula, What is Retail Selling? A taxpayer's uncle is a related party for purposes of Section 267. As a member, you'll also get unlimited access to over 84,000 The SEC's adoption of its newest auditing standard, Auditing Standard (AS) No. In other words, inquire of the CEO and CFO, but also ask questions of others such as the cash receipts or the accounts payable supervisor. Create your account, 13 chapters | Get Your Copy of Audit Risk Assessment Made Easy Click the Book, Get Your Copy of The Why and How of Auditing Click the Book.

Item 404 of Regulation S-K defines it as any immediate family member of a director or executive officer of the registrant, or of any nominee for director when the information called for by paragraph (a) of this item is being presented in a proxy or information statement relating to the election of that nominee for director, which means any child, step-child, parent, step-parent, spouse, sibling, mother-in-law, father-in-law, son-in-law, daughter-in-law, brother-in-law, sister-in-law of such director, executive officer or nominee for director, and any person (other than a tenant or employee) sharing the household of such director, executive officer or nominee for director..

For example, if the CEO personally owns an office and rents it to the company, that is an example of a related party transaction. The image below lists out some common scenarios that may indicate the transaction is with a related party: Yes, absolutely.

I'd like to receive the free email course. Log in or sign up to add this lesson to a Custom Course. This article explains how to understand and find fraudulent related party transactions. - Techniques & Process. ASC 850-10 details the specific disclosure requirements: If your disclosure represents that the transactions were conducted at arms length and on terms equivalent for arms length transactions, these representations must be able to be substantiated. Its like a teacher waved a magic wand and did the work for me. For example, a business might rent real estate from a commonly owned entity. The result: expenses in the current year and revenue in the subsequent year. After logging in you can close it and return to this page. 0 && stateHdr.searchDesk ? Even if related party transactions are legitimate, businesses are required to disclose them. They need another $300,000. Most often, the confusion stems from the definition of immediate family. The ASC Glossary defines immediate family as family members who might control or influence a principal owner or a member of management, or who might be controlled or influenced by a principal owner or a member of management, because of the family relationship. However, before you begin to interpret who may be related parties for your entity, you will need to consider which guidance applies to your entity. Internal control to test for credit approval? I feel like its a lifeline. On the surface, related party transactions are not treated any different from an accounting perspective, however, you will likely need to look closely at the specific terms. Do you desire to increase your knowledge of fraud prevention and detection? - Definition & Example, What Is Residual Income? Much of these dividends were then reinvested back into the company to reduce related party transactions, which at the time were around 14% of the loan book. Often the auditor will obtain an understanding of your entitys related party identification, transaction authorization and approval and tracking processes, perform inquiries, review Board of Director and Committee minutes for indications of omitted transactions or relationships and test the accuracy of the related party listing to underlying support. So, see if the economics make sense. There are two auditing standards that require your auditor to evaluate the identification and disclosure of related party relationships and transactions as part of the audit procedures. For the last thirty years, he has primarily audited governments, nonprofits, and small businesses.