trinity university withdrawal

This rule is discussed in Pye (2010) and also Pye (2012). Whether youre ready to declare a major, minor, or cluster, the Office of the Registrar has the necessary forms and will process the paperwork. B)LH*H#qK +2}\Y[&1Xq$g`L$Rwh86xF3]xME(LU5Hj8!9V+)tf>_Z|byqZC[;| 69`gO WED~

Some people believe that the original study shows that this will sustain forever. The Poor Swiss a message here. Another major uncertainty is the amount of spending that will be required each period to provide a given standard of living.

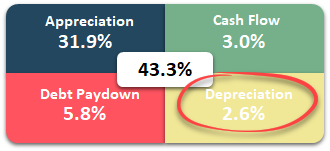

This does not mean that you should optimize for the highest worst duration either.  So balance is essential. In this article, you will find how I did it and all the results I have gathered from this data! Does the Trinity Study work in recent years? Basically, now, you should have an idea of how much you need per year. This rule states that if you only withdraw 4% of your initial portfolio every year, you can sustain your lifestyle for a very long period. 15K2v!HTG@O@o`!9`~-Q0-j?o7tL{/z[F?c)+hu>G#l="4[K@KUq'eRpb There is something important with these measurements: the success rate does not tell the entire story. The PDF will include all information unique to this page. Facebook Twitter YouTube Instagram LinkedIn, Facebook Twitter YouTube Instagram Pinterest, 22500 University Drive, Langley, BC, Canada | V2Y 1Y1 You should also choose a Withdrawal Rate for your situation. 3) Yes, you read that correctly. hbbd```b``z"[ D2Iof/ 6) u6`sjf%f`h7 @q[ Htm@"@y60 5c

This is significantly more than I expected. We will focus on the median since it is generally more representative than the average. 127 0 obj

<>stream

I dont have enough historical data to run simulations on these portfolios. After reviewing your completed form, hit the Submit button located at the bottom. Your advisor can walk you through the forms, clarify registration and graduation requirements, and help you gather any required approvals. 98% to last 50 years, but a chance of running out after ten years, 96% to last 50 years, but a chance of running out after 48 years. The authors backtested a number of stock/bond mixes and withdrawal rates against market data compiled by Ibbotson Associates covering the period from 1925 to 1995. This is the amount that you need to be financially independent.

So balance is essential. In this article, you will find how I did it and all the results I have gathered from this data! Does the Trinity Study work in recent years? Basically, now, you should have an idea of how much you need per year. This rule states that if you only withdraw 4% of your initial portfolio every year, you can sustain your lifestyle for a very long period. 15K2v!HTG@O@o`!9`~-Q0-j?o7tL{/z[F?c)+hu>G#l="4[K@KUq'eRpb There is something important with these measurements: the success rate does not tell the entire story. The PDF will include all information unique to this page. Facebook Twitter YouTube Instagram LinkedIn, Facebook Twitter YouTube Instagram Pinterest, 22500 University Drive, Langley, BC, Canada | V2Y 1Y1 You should also choose a Withdrawal Rate for your situation. 3) Yes, you read that correctly. hbbd```b``z"[ D2Iof/ 6) u6`sjf%f`h7 @q[ Htm@"@y60 5c

This is significantly more than I expected. We will focus on the median since it is generally more representative than the average. 127 0 obj

<>stream

I dont have enough historical data to run simulations on these portfolios. After reviewing your completed form, hit the Submit button located at the bottom. Your advisor can walk you through the forms, clarify registration and graduation requirements, and help you gather any required approvals. 98% to last 50 years, but a chance of running out after ten years, 96% to last 50 years, but a chance of running out after 48 years. The authors backtested a number of stock/bond mixes and withdrawal rates against market data compiled by Ibbotson Associates covering the period from 1925 to 1995. This is the amount that you need to be financially independent.

Any person mayreport discrimination, sexual harassment and sexual misconductonline or by contactingTrinity'sTitle IX Coordinator,Angela Miranda-Clark.

I have completed its data with the missing years using the same methodology. I want to know more about this kind of simulation. Another interesting thing from the study was that they also compared the terminal values of the different withdrawal rates and portfolios. This means after how many months can you see the first failure can happen. during their retirement years before passing away; capital preservation was not a primary goal, but the "terminal value" of portfolios was considered for those investors who may wish to leave bequests. Click on "Application for Graduation" after logging on to the student menu. Contact us here. A withdrawal rate of around 3.5% would be safer for most people. Fonda, Daren (2008), "The Savings Sweet Spot," SmartMoney, April, 2008, pp. For questions about forms, student data, or the status of submitted documents, please contact the Office of the Registrar at registrar@trinity.edu or (210) 999-7201. 2) What is the difference between the Updated Trinity Results 50 year results and the Success Rate for a simulation of 50 years? Your transcript contains your official permanent academic record and is certified by the University Registrar. Week 6 40%.  In finance, investment advising, and retirement planning, the Trinity study is an informal name used to refer to an influential 1998 paper by three professors of finance at Trinity University. So, another quite important metric is the worst duration of a scenario. For further information and assistance on withdrawing from summer courses, pleasevisit our Summer Sessions page. Finally, they also provided the terminal values of the portfolio. You can seek guidance from your own dedicated Academic Advisor at any time! I wanted to say that I used more recent data by including 2021, unlike the original study. Mid-course corrections likely will be required, with the actual dollar amounts withdrawn adjusted downward or upward relative to the plan. It is an excellent research paper done by three professors from Trinity University. 112 0 obj

<>/Filter/FlateDecode/ID[<70B6F123F2054F298375570C5F4DAC60>]/Index[87 41]/Info 86 0 R/Length 116/Prev 759202/Root 88 0 R/Size 128/Type/XRef/W[1 3 1]>>stream

If the study is excellent, why did I want to redo it? If you want real chances of success, you will need more than 50% of your portfolio allocated to stocks. They examined payout periods from 15 to 30 years, and withdrawals that stayed level or increased with inflation. Therefore, I reproduce the original studys results with recent data, all the way to 2021! Although the original research was not about early retirement, it is often referred to in the Financial Independence and Retire Early (FIRE) movement! A weekly email with my Best Personal Finance and Investing articles, for free and without spam! It is important to note that the original research was not about early retirement but official retirement. All wheather portfolio by Ray Dalio (http://www.lazyportfolioetf.com/allocation/ray-dalio-all-weather/) Refund percentage is dependent on the course length and program. Obviously, the higher the success rate, the better the results are. Condensed courses (5+ weeks) may qualify for the following pro-rated refund schedule: Week 1 100%

In finance, investment advising, and retirement planning, the Trinity study is an informal name used to refer to an influential 1998 paper by three professors of finance at Trinity University. So, another quite important metric is the worst duration of a scenario. For further information and assistance on withdrawing from summer courses, pleasevisit our Summer Sessions page. Finally, they also provided the terminal values of the portfolio. You can seek guidance from your own dedicated Academic Advisor at any time! I wanted to say that I used more recent data by including 2021, unlike the original study. Mid-course corrections likely will be required, with the actual dollar amounts withdrawn adjusted downward or upward relative to the plan. It is an excellent research paper done by three professors from Trinity University. 112 0 obj

<>/Filter/FlateDecode/ID[<70B6F123F2054F298375570C5F4DAC60>]/Index[87 41]/Info 86 0 R/Length 116/Prev 759202/Root 88 0 R/Size 128/Type/XRef/W[1 3 1]>>stream

If the study is excellent, why did I want to redo it? If you want real chances of success, you will need more than 50% of your portfolio allocated to stocks. They examined payout periods from 15 to 30 years, and withdrawals that stayed level or increased with inflation. Therefore, I reproduce the original studys results with recent data, all the way to 2021! Although the original research was not about early retirement, it is often referred to in the Financial Independence and Retire Early (FIRE) movement! A weekly email with my Best Personal Finance and Investing articles, for free and without spam! It is important to note that the original research was not about early retirement but official retirement. All wheather portfolio by Ray Dalio (http://www.lazyportfolioetf.com/allocation/ray-dalio-all-weather/) Refund percentage is dependent on the course length and program. Obviously, the higher the success rate, the better the results are. Condensed courses (5+ weeks) may qualify for the following pro-rated refund schedule: Week 1 100%

My U.S. data s based on the data made available by Big ERN in its Safe Withdrawal Rate series. endstream endobj 91 0 obj <>stream Leveraged ETF (2x/3x of stocks and bonds) But even a portfolio with 100% stocks has only an 85% chance of success after 30 years with 4.5%. But it is still not bad at all with reasonable withdrawal rates. For dropping a modular course (i.e. Lets see what success rates we have when we ignore inflation. Students withdrawing by the last day to drop classes will receive a W designation (withdrawal) for all classes. I have learned many things from the results. For further informationplease contactour Travel Studies page. hb```VXa`0p{0mM f ct Secondly, the original study only covered up to thirty years of retirement. If during the LOA students find that they must withdraw from the university or need further extended leave beyond what was originally filed, they must communicate their intentions with the Student Life office. What do you think of these results? Weeks 3 to 6 1) Very good catch, I have fixed the graph, it was not exactly the same as 40-year, but it was not correct either. Week 4+ 0%. After the first day of class, no refunds will be issued. Please let me know what you think in the comments below! Their research papers goal was to see which withdrawal rates people should use to sustain a particular lifestyle for up to 30 years. Hi, thank you for this interesting and valuable work. The form must be submitted prior to the proposed leave. 2. The authors also took inflation into account in the results. Overall, it was a lot of fun preparing the data for this article. For people retiring early, I think that 50 years is not unreasonable. Weeks 3 to 6 So, the success rate is the percentage of the months that end up with success. The initial portfolio is the amount you have on the day you retire. To withdraw from a spring 2021 course, obtain instructor and advisor approvals by email and send them with your request toregistrar@trinity.edu, Planning the path to graduation can be overwhelming. In particular, the initial withdrawal is related to the prior standard of living of the retiree, not just the withdrawal that is reasonably sustainable. However, Big ERN did something about CAPE and simulations: https://earlyretirementnow.com/2017/08/30/the-ultimate-guide-to-safe-withdrawal-rates-part-18-flexibility-cape-based-rules/.

Weeks 1 & 2 We strive to maintain accurate student records, protect the security of those records and related student data, and provide a wide range of support services related to registration and graduation. Also, they tested portfolios with between 0% and 100% stocks by jumps of 25%. Great article, Im curious as to where you get your data from in regards to the Stock market performance and if you can kindly share it. However, there are two caveats to the original study. I wanted to ensure the results were holding with more recent stock market behavior. We can see that the results are comparable. If you want to use the graphs in this article, I would ask that you cite this article as the source of the image! Most people in retirement will withdraw money monthly. From there, you can know your FI Number. It is assumed that the portfolio needs to last thirty years.

This study researched different withdrawal rates for retirement.

Thanks.

Ultimately, I want to extend the Trinity Study to the European markets. Hn1~umwD3 ** Applications must be submitted using TigerPAWS. The investor needs to keep in mind that selection of a withdrawal rate is not a matter of contract but rather a matter of planning. I am glad you like and thanks for pointing out the issues!

For a withdrawal rate of 3.5%, which is my current target, the median terminal value after 30 years is about 6700 dollars! If you choose a reasonable withdrawal rate, you will likely end up with much more money than when you started! It is better to call it The 4% Rule of Thumb. Thanks for the kind words! For more information, I have compared different rebalancing methodologies for retirement. But Ray Dalios portfolio only has 30% in stocks, I dont think it will perform well in the long-term. Week 5 50% But I believe that it is not common.

I will have to run more simulations. Some of the form fields may auto-populate, but for those that do not please fill out all applicable fields. Lets see again with 20 years to compare the results: As we can see, inflation causes a significant hit to our chances of success! Hello sir, I am still confused between initial portfolio at the time of retirement and current portfolio. We can see that increasing the number of years decrease the likelihood of success. I did not show the minimum values. And it still stands accurate up to 2021! Is that right? Withdrawals are based on the current allocation. Also, the withdrawal for a period is reduced when a test indicates that such retrenchment is necessary. Deadline is 4:00 p.m. of the semester Add/Drop date, as published in the Academic Calendar.

If you are not a coder, I also have an online FIRE calculator that can do most of the calculations presented here. I will update this phrase. A student who desires not to register for classes for a period of one to three semesters (a maximum of twelve months) should request a leave of absence (LOA) via the academic withdrawal/leave of absence form available from the Student Life Office (studentlife@tiu.edu). hnF_e/{$I6,'nVTH>}YJHVMXjw*DkZF(MjXH(BO)SJ)3\RVAe It is a good dataset that has been tested several times already. The procedure for determining a safe withdrawal rate from a retirement portfolio in these studies considers only the uncertainty arising from the future returns to be earned on the investment. Good question.

Since we see that reasonable withdrawal rates are in the range of 3% to 6%, lets try more withdrawal rates. %%EOF

Due to the COVID-19 pandemic, the Registrars Office is currently providing services remotely via Zoom appointments and can be reached at registrar@trinity.edu. A LOA may be granted for personal, financial, or other reasons, but the expectation is that students will return to their program within a twelve-month period. Do you have ideas on what kind of simulations I should run next? But I will try to find it for as many years as possible. And then, they are not covering more than thirty years of retirement.

They are subject to change without notice. Now 6% is the limit. The withdrawals may exceed the income earned by the portfolio, and the total value of the portfolio may well shrink during periods when the stock market performs poorly. Your comment may not appear instantly since it has to go through moderation. The original study was only covering years up to 1995. Would you like to know precisely which withdrawal rate is safe and will sustain your lifestyle for a very long time? So this simulation will cover returns until the end of 2021! For instance, if your base allocation to stocks is 60%, but your current allocation is 80%, 80% of the withdrawal will be taken from stocks. Its now using 50-year data. Historically, a 3.2% withdrawal rate with a 80% stocks portfolio would never have failed. I am confused about the worst duration section and what it is trying to say.

A LOA may be granted for personal, financial, or other reasons, but the expectation is that students will return to their program within a twelve-month period. There is no refund for class, activity, or student association fees after Week 2 of the semester. Every possible starting month in the available data is tested. This is a failure if the portfolio runs out of money before that (could be in the first year or the nineteenth year). On average, your retirement money will double during the ten additional years. Big ERN made all this available for free. For instance, if we simulate for 20 years and end up with one dollar after 20 years, it is a success. Thank you!

A student is not eligible for refunds (where applicable) and forfeits academic standing in the college if this form is not properly completed and submitted. Any withdrawal rate higher than 8% does not make sense in the long term, even without inflation. This occurs when the risk of running out of funds before the end of a plan has become too high given the size of the then current withdrawal and the funds that remain. Seems like it would be a bad scenario. +1.888.468.6898, COURSE WITHDRAWAL for UNDERGRADUATE STUDIES, COURSE WITHDRAWAL for GRADUATE STUDIES (Select Programs), Course Withdrawal for Graduate Studies (Select Programs) & all Acts Students, Sexualized Violence Information and Response, Nursing (start date prior to Sept 1, 2017), Nursing (start date later than Sept 1, 2017).

You may also report in person or by mail addressed to her at One Trinity Place, Northrup Hall 210Q, San Antonio, TX 78212. During this period, courses can only be dropped due to severe extenuating circumstances after approval by the Registrar.

All refunds are based on the date of official withdrawal from the college. a detailed article about the Trinity Study, different rebalancing methodologies for retirement, stocks are more subject to sequences of return risks.

Thats indeed the case for each 100% success rate simulation. You can send Mr. Because if your highest duration is 40 years, but you have only a 50% chance of reaching 50 years, this is gambling, not planning. One Trinity Place, San Antonio, TX 78212-7200. Save my name, email, and website in this browser for the next time I comment. Policy for Students Called to Active Military Duty, One Mission, Many Stories: Planning Your Trinity College Academic Program, Trinity International University - Florida, program statute of limitation clock keeps ticking. Contact the Student Life Office (StudentLife@twu.ca) in the Reimer Student Centre to fill out the Withdrawal from University form and Course Withdrawal form. Trinityprohibits harassment and discrimination based on protected status, includingsexual harassment and sexual misconduct. bD#Nzk)fL#tDhPM&9FUEQQKA3+_5v:F*74f5#_1 oEt&b|9gLz9~TSWbhY&Bn}?+`+YJI{R*%Dr;PD(lxz.A$Jj+Y66q"- w5k2A~.Q=#klzIqFaD&QD#WGROSFxAJ\Z>$N(`S

GP}]8`86A Xh7D/##`m[n`>G:` Your email address will not be published. All forms, requests, and approvals can be submitted to us via email for the time being. An update of their results using data through 2009 is provided in Pfau (2010). At the end of the leave, arrangements for course registration and returning to school should be made directly with the Academic Records office. Moreover, your withdrawal rate will depend on your portfolio and asset allocation to stocks and bonds. All rights reserved. Courses withdrawn during Weeks 3 to 6 of the semester will receive a pro-rated refund of tuition based on the date of withdrawal, and the registration changes must be completed by the Office of the Registrar. It was fascinating to reproduce these results. For instance, for you, which of these two scenarios is better: For me, the second scenario is better. Unless you have 100% of stocks, your success rate will be less than 90%. The maximum values do not mean a lot.